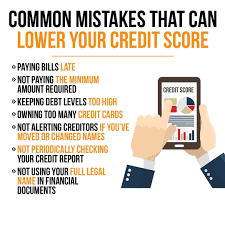

5 Mistakes That Can Lower Your Credit Score and How to Avoid Them

Your credit score plays a crucial role in your financial life. It determines whether you qualify for loans, credit cards, rental applications, and even certain jobs. Yet, many people unintentionally hurt their scores through common mistakes. Understanding these pitfalls—and how to avoid them—can save you money and stress in the long run.

1. Missing Payments

Why It Hurts:

Payment history makes up 35% of your credit score, making it the most important factor. A single late payment—especially one over 30 days—can cause a significant drop in your score. Repeated missed payments can stay on your credit report for up to seven years.

How to Avoid It:

- Set up automatic payments for credit cards, loans, and bills.

- Use reminders or calendar alerts to track due dates.

- If you can’t make the full payment, pay at least the minimum amount to avoid being reported as delinquent.

2. Maxing Out Credit Cards

Why It Hurts:

Your credit utilization ratio—the amount of credit you use compared to your limit—accounts for about 30% of your credit score. High balances (over 30% of your available credit) signal financial risk, even if you pay on time.

Example:

If you have a $1,000 limit, try not to carry a balance higher than $300.

How to Avoid It:

- Keep balances low and pay off purchases frequently.

- Consider requesting a credit limit increase, but avoid spending more just because your limit is higher.

- Use multiple credit cards responsibly to spread utilization.

3. Closing Old Credit Accounts

Why It Hurts:

Closing old accounts shortens your credit history and can reduce your available credit, both of which can negatively impact your score. The length of credit history makes up about 15% of your score, so older accounts help show long-term responsible behavior.

How to Avoid It:

- Keep older accounts open, even if you don’t use them frequently.

- Use old cards occasionally for small purchases to keep them active.

- If you must close an account, close newer ones first to preserve credit history length.

4. Applying for Too Much Credit at Once

Why It Hurts:

Every time you apply for a new credit card or loan, a hard inquiry appears on your credit report. Too many hard inquiries in a short period can lower your score and signal financial instability to lenders.

How to Avoid It:

- Space out credit applications by at least six months.

- Only apply for credit you truly need.

- Check pre-qualification offers, which use soft inquiries and don’t affect your score.

5. Ignoring Your Credit Report

Why It Hurts:

Errors, fraudulent accounts, or outdated information can drag down your score without you realizing it. According to studies, one in five credit reports contains errors that may affect credit decisions.

How to Avoid It:

- Review your credit reports from Equifax, Experian, and TransUnion annually

- Dispute inaccuracies immediately.

- Consider using a credit monitoring service for alerts about suspicious activity.

Additional Habits That Can Help

- Make payments early or on time every month.

- Diversify your credit mix (credit cards, installment loans, etc.) to show financial responsibility.

- Maintain low debt levels to demonstrate strong money management.

Final Thoughts

Your credit score is one of the most valuable financial tools you have. Avoiding these five mistakes—missing payments, maxing out cards, closing old accounts, applying for too much credit, and ignoring your report—can help you maintain a healthy score. With good credit, you’ll enjoy lower interest rates, better loan approvals, and more financial freedom.