How to Buy Stocks Online: A Beginner’s Guide to Investing

Buying stocks online has never been easier. With the rise of user-friendly trading platforms and commission-free brokerages, anyone with a smartphone or computer can start investing in just a few minutes. However, before clicking the “buy” button, it’s important to understand the process, risks, and strategies involved in stock investing.

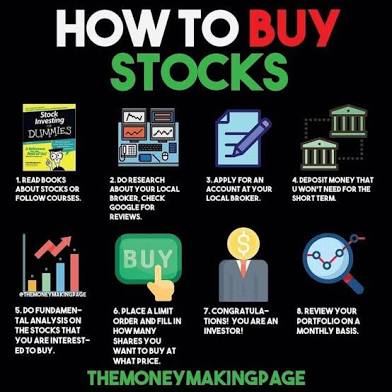

This guide breaks down how to buy stocks online step by step, along with tips to make smart investment decisions.

1. Understand What Stocks Are

A stock represents ownership in a company. When you buy shares, you become a partial owner of that business and may earn returns through:

- Capital Appreciation: When the stock price increases.

- Dividends: Profit payouts made to shareholders.

Stocks can be volatile, but they historically offer higher returns than most other investments over the long term.

2. Open a Brokerage Account

To buy stocks online, you need a brokerage account—a platform that allows you to purchase and sell securities.

Types of Online Brokerages:

- Full-Service Brokers: Offer personalized advice, portfolio management, and research tools (e.g., Fidelity, Charles Schwab).

- Discount Brokers: Focus on low-cost trading with minimal frills (e.g., Robinhood, Webull).

- Robo-Advisors: Automated platforms that invest on your behalf (e.g., Betterment, Wealthfront).

What to Consider When Choosing a Brokerage:

- Fees and commissions (look for zero-commission trading).

- User interface and ease of use.

- Availability of research tools and educational resources.

- Account minimums (many brokers require $0 to start).

3. Fund Your Account

Once you open a brokerage account, transfer money from your bank to start investing.

- Electronic transfer (ACH): Fast and convenient.

- Wire transfer: Faster for larger deposits, but may have fees.

Some platforms allow fractional share purchases, meaning you can start investing with as little as $1.

4. Research Stocks Before Buying

Successful investing starts with research. Consider the following factors:

- Company Fundamentals: Revenue, profits, debt levels, and overall financial health.

- Industry Trends: How competitive is the sector? Is it growing or declining?

- Valuation Metrics: Price-to-earnings (P/E) ratio, dividend yield, and earnings growth.

- News & Market Sentiment: Recent events that could impact the stock price.

Tools to Use:

- Yahoo Finance, MarketWatch, or your brokerage’s built-in research tools.

5. Decide How Many Shares to Buy

Determine how much money you want to invest in a specific stock and calculate how many shares you can afford.

Example:

If a stock trades at $50 and you want to invest $500, you can purchase 10 shares.

Alternatively, you can buy fractional shares if your budget doesn’t cover a full share.

6. Choose the Right Order Type

When buying stocks online, you’ll need to select an order type:

- Market Order: Buys stock at the current price (fast but may vary slightly).

- Limit Order: Sets a specific price at which you’re willing to buy.

- Stop Order: Automatically buys (or sells) once the stock hits a certain price.

For beginners, market orders are simplest, while limit orders provide more control.

7. Place Your Trade

Once you’ve chosen the stock, number of shares, and order type:

- Review your order to ensure accuracy.

- Confirm the trade.

- Monitor your brokerage account to see when the order is executed.

8. Monitor Your Investments

After buying stocks, keep track of their performance—but avoid checking constantly, as short-term fluctuations are normal.

- Track Portfolio Performance: Use your brokerage dashboard or apps like Yahoo Finance.

- Stay Informed: Follow company news and industry developments.

- Review Annually: Adjust your portfolio based on your goals and market conditions.

9. Diversify to Reduce Risk

Avoid putting all your money into one stock. Spread your investments across:

- Different industries (tech, healthcare, consumer goods).

- Different asset types (stocks, ETFs, bonds).

Diversification helps protect your portfolio from big losses if one stock performs poorly.

10. Avoid Common Beginner Mistakes

- Investing Without Research: Don’t buy based on hype or social media trends.

- Overtrading: Constant buying and selling increases fees and taxes.

- Ignoring Fees: Even small fees can reduce returns over time.

- Panic Selling: Don’t sell during short-term dips—investing is a long-term game.

11. Consider Long-Term Strategies

While buying individual stocks can be exciting, beginners may want to combine stock investing with broader strategies:

- Index Funds & ETFs: Provide instant diversification and lower risk.

- Dividend Investing: Focuses on stocks that pay regular dividends for steady income.

- Dollar-Cost Averaging: Invest a fixed amount regularly to smooth out market volatility.

Example: Buying Your First Stock Online

Let’s say you have $1,000 to invest.

- Open a brokerage account with Fidelity or Robinhood.

- Deposit funds from your bank.

- Research a company like Apple (AAPL) and review its financials.

- Decide to invest $500 in Apple, purchasing fractional shares if needed.

- Use a market order to buy immediately.

- Monitor performance and reinvest dividends over time.

Final Thoughts

Buying stocks online is straightforward, but smart investing requires planning, research, and patience. Start small, diversify your portfolio, and focus on long-term growth. With the right approach, you can confidently build wealth and take control of your financial future.