Strategies for Paying Off Credit card Debt Faster: A Complete Guide

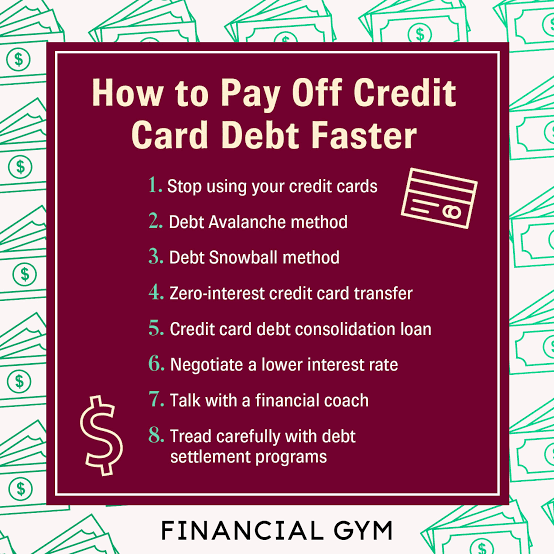

Managing credit card debt can feel overwhelming, especially when high-interest rates make it seem like you’re not getting anywhere. But with the right strategies and discipline, paying off credit debt faster is achievable. This guide will explore effective ways to eliminate your credit card balance faster, reduce the amount you pay in interest, and regain control of your finances.

1. Create a Budget and Track Your Spending

The first step in paying off credit debt faster is to understand where your money is going. Start by creating a budget that outlines your income, monthly expenses, and any debt obligations. Be sure to track your spending daily so you can spot areas where you might be overspending. Cutting back on non-essential expenses like dining out, subscriptions, and impulse purchases can free up more money to put toward your credit card debt.

Tips for Budgeting:

- Use budgeting apps like Mint or YNAB (You Need A Budget) to keep track of your spending.

- Follow the 50/30/20 rule, which allocates 50% of your income to essentials, 30% to discretionary spending, and 20% to savings and debt.

2. Focus on High-Interest Debt First

Not all credit card debt is created equal. Some cards come with significantly higher interest rates than others. Paying off high-interest debt first, while making minimum payments on lower-interest balances, can save you a lot of money in the long run. This strategy is known as the avalanche method.

How the Avalanche Method Works:

- List your credit card debts in order of interest rate, from highest to lowest.

- Put any extra funds toward the card with the highest interest rate.

- Once that card is paid off, move on to the next highest-interest card.

This method reduces the amount of interest you pay over time, allowing you to pay off your balance faster.

3. Consider the Snowball Method

If you’re someone who needs quick wins to stay motivated, the snowball method might be a better fit. With this approach, you focus on paying off the smallest debt first, regardless of interest rates. Once that balance is paid off, you move on to the next smallest debt, and so on.

While you may pay a little more in interest over time using this method, the psychological benefits of eliminating debts quickly can keep you motivated to continue.

4. Increase Your Minimum Payments

Paying only the minimum payment on your credit card can keep you in debt for years and cost you a lot in interest. Instead, commit to paying more than the minimum whenever possible. Even small increases in your payments can make a big difference in how quickly you pay off your debt.

How to Do This:

- Automate your payments to ensure you never miss a due date and to help you stay consistent.

- Make biweekly payments instead of monthly payments to reduce the balance faster and lower interest costs.

5. Transfer Your Balance to a Low-Interest Card

A balance transfer can be a great option if you’re looking to lower the interest on your existing credit card debt. Many credit cards offer low or 0% APR for balance transfers for an introductory period (usually between 6-18 months). By transferring your balance to a card with lower interest, you can pay down the principal faster, with less money spent on interest.

Considerations for Balance Transfers:

- Look for fees: Balance transfers usually come with a fee, typically between 3-5% of the transferred amount.

- Pay off the balance before the introductory period ends to avoid higher interest rates after the promotion expires.

6. Consolidate Your Debt with a Personal Loan

If you have multiple credit card balances, consolidating your debt with a personal loan might be a good option. A personal loan typically offers a lower interest rate than most credit cards, and consolidating your debt into one payment can simplify your finances. This allows you to focus on paying down the principal without worrying about multiple interest rates.

How to Consolidate Debt:

- Research personal loans from different lenders, such as banks, credit unions, and online lenders.

- Use the loan to pay off your credit card debt and then focus on repaying the loan at a lower interest rate.

7. Cut Back on Unnecessary Expenses

Once you’ve assessed your spending habits and created a budget, it’s time to make sacrifices in your lifestyle. Cutting back on unnecessary expenses will allow you to allocate more money to your credit card payments. Look for areas where you can reduce spending, such as:

- Dining out less: Cook at home more often or pack lunch for work.

- Canceling unused subscriptions: Eliminate any subscriptions or memberships you no longer use.

- Reduce impulse buying: Avoid purchasing non-essential items, especially when shopping online.

8. Increase Your Income

Another way to pay off credit card debt faster is to increase your income. You can do this by:

- Taking on a side job: Find freelance or gig opportunities, such as driving for a rideshare service or offering consulting services.

- Selling unused items: Sell things you no longer need through online marketplaces or garage sales.

- Asking for a raise: If your performance at work is strong, consider negotiating a raise to boost your income and put more toward your debt.

Increasing your income can make a big difference in how quickly you pay off your credit card debt. Even a few hundred extra dollars a month can significantly reduce the time it takes to become debt-free.

9. Take Advantage of Windfalls

Any unexpected financial windfall, such as a tax refund, bonus, or gift, can be put directly toward paying off your credit card debt. While it might be tempting to use that money for something fun, prioritizing debt repayment can bring long-term financial freedom.

10. Negotiate with Your Credit Card Issuer

Sometimes, your credit card issuer may be willing to work with you to lower your interest rate, especially if you have a good payment history. Call your credit card company and ask if they offer any promotional rates or if they can reduce your interest rate for a specific period.

If they don’t agree to reduce your rate, ask about other options such as forbearance programs or payment plans that could help you pay off your balance more efficiently.

11. Avoid Adding to Your Debt

One of the most important aspects of paying off credit debt faster is to avoid adding to it. Try to keep your credit card usage to a minimum while you’re working on paying off the debt. This means only using your credit cards for emergencies or essential purchases.

Set clear boundaries for yourself and stick to them. If necessary, leave your credit cards at home when you go out to avoid the temptation of using them.

12. Stay Consistent and Patient

Paying off credit card debt can take time, but staying consistent with your efforts will pay off. Celebrate small wins along the way, such as paying off one card or reducing your balance by a set amount. The more disciplined you are with your finances, the sooner you’ll be able to pay off your debt and enjoy financial freedom.

Final Thoughts

Paying off credit card debt faster isn’t an overnight process, but by following these strategies, you can significantly reduce your balance and save money on interest. The key is to stay organized, prioritize your payments, and be disciplined with your spending. With patience and dedication, you’ll be on your way to living a debt-free life sooner than you think.