The 50/30/20 Budget Rule: A Beginner’s Guide to Smarter Money Management

Managing personal finances can feel overwhelming, especially when juggling expenses, savings goals, and the occasional splurge. One budgeting method that simplifies the process and helps people take control of their money is the 50/30/20 budget rule. This method provides a clear structure for managing income while allowing room for both essential needs and personal enjoyment.

In this guide, we’ll explain what the 50/30/20 rule is, how to apply it to your finances, and tips to make it work for your unique lifestyle.

What is the 50/30/20 Budget Rule?

The 50/30/20 budget rule is a simple financial framework designed to help you allocate your income in a balanced and sustainable way. It was popularized by U.S. Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan and is widely used because of its simplicity and flexibility.

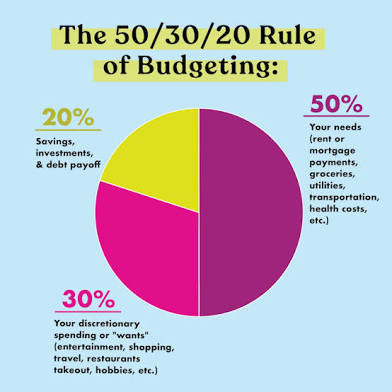

The rule breaks down your after-tax income into three categories:

- 50% for Needs – Essential expenses you must pay to live and work.

- 30% for Wants – Non-essential purchases that improve your lifestyle.

- 20% for Savings and Debt Repayment – Building financial security and preparing for the future.

Step 1: Calculate Your After-Tax Income

Before you can apply the 50/30/20 rule, you need to know your after-tax income—the amount you actually take home after taxes and deductions like Social Security, Medicare, or retirement contributions.

- Salary Employees: Use your net income shown on your pay stub.

- Freelancers or Contractors: Deduct taxes, health insurance, and other expenses from gross income to determine your true take-home pay.

- Variable Income: Calculate an average monthly income over the past six months to get a realistic budget base.

Step 2: Allocate 50% to Needs

Needs are the essentials you must cover to maintain a basic standard of living. These are non-negotiable expenses that would directly impact your well-being if unpaid.

Examples of needs include:

- Rent or mortgage payments

- Utilities (electricity, water, heating)

- Groceries (basic food items, not luxury snacks)

- Health insurance and medical bills

- Transportation (car payments, gas, or public transit)

- Minimum debt payments

Tip: If your essential expenses exceed 50% of your income, consider ways to reduce costs—such as downsizing housing, refinancing loans, or using public transportation.

Step 3: Allocate 30% to Wants

Wants are non-essential purchases—things that make life enjoyable but are not strictly necessary. This category provides flexibility and helps you avoid feeling deprived while budgeting.

Examples of wants include:

- Dining out at restaurants

- Streaming subscriptions (Netflix, Spotify, etc.)

- Vacations and weekend getaways

- Shopping for clothes beyond basic needs

- Gym memberships or hobbies

Tip: Be honest with yourself about what’s a “want” versus a “need.” For example, groceries are a need, but gourmet food or takeout multiple times a week falls under wants.

Step 4: Allocate 20% to Savings and Debt Repayment

This final portion of your budget helps you build financial security and work toward long-term goals.

This category includes:

- Emergency fund contributions

- Retirement savings (401(k), IRA, or Roth IRA)

- Extra debt payments (beyond minimums)

- Investments in index funds, stocks, or ETFs

- Saving for big purchases (home, car, education)

Tip: If you have high-interest debt (like credit card balances), prioritize paying it down quickly to avoid costly interest charges.

Why the 50/30/20 Rule Works

The beauty of the 50/30/20 budget rule is its simplicity. Unlike complex spreadsheets or restrictive plans, this method allows you to balance financial responsibility with lifestyle enjoyment. Some key benefits include:

- Flexibility: Can be applied to any income level and adjusted as life changes.

- Clarity: Gives a clear picture of how your income should be divided.

- Balance: Encourages saving without eliminating room for fun.

- Ease of Use: No complicated tracking—just follow three simple categories.

Example of the 50/30/20 Rule in Action

Let’s say your after-tax income is $4,000 per month. Here’s how the 50/30/20 breakdown would work:

- 50% for Needs: $2,000

- Rent/Mortgage: $1,200

- Utilities & Groceries: $600

- Transportation: $200

- 30% for Wants: $1,200

- Dining Out & Entertainment: $400

- Shopping & Hobbies: $500

- Subscriptions & Vacations: $300

- 20% for Savings/Debt Repayment: $800

- Emergency Fund: $200

- Retirement Savings: $400

- Extra Debt Payments: $200

This simple structure keeps your financial priorities organized while leaving room for flexibility.

Tips to Make the 50/30/20 Rule Work for You

- Track Your Spending

Use budgeting apps like Mint, YNAB, or EveryDollar to monitor where your money is going and ensure it aligns with the 50/30/20 ratio. - Adjust as Needed

If living in a high-cost area makes it hard to keep needs within 50%, reduce wants or increase income to stay on track. - Automate Savings

Set up automatic transfers to your savings or retirement account so you never forget or overspend. - Start Small

If saving 20% feels impossible, start with 10% and work your way up as you cut expenses or increase income. - Review Regularly

Reassess your budget every few months or after major life changes—new job, relocation, or family additions.

Common Mistakes to Avoid

- Misclassifying Wants as Needs: Streaming services and dining out are not necessities.

- Ignoring Irregular Expenses: Annual bills like insurance premiums or holiday shopping should be factored into your budget.

- Forgetting to Adjust Income: If your pay increases or decreases, update your budget accordingly.

- Not Saving for Emergencies: Without an emergency fund, unexpected expenses can derail financial plans.

Final Thoughts

The 50/30/20 budget rule is one of the simplest and most effective ways to take control of your finances. By dividing your income into clear categories—needs, wants, and savings—you can create a balanced approach that allows you to live comfortably today while building security for tomorrow.

Whether you’re just starting your financial journey or looking to improve your current money habits, this method can help you stay on track, reduce stress, and achieve your financial goals with confidence.